News Category

Agria Reports Financial Results for Fiscal Year 2016

HONG KONG, CHINA -- (Marketwired) -- August 19, 2016 -- Agria Corporation (NYSE: GRO) (the "Company" or "Agria"), a global agricultural company, today announced its financial results for the twelve months ended June 30, 2016.

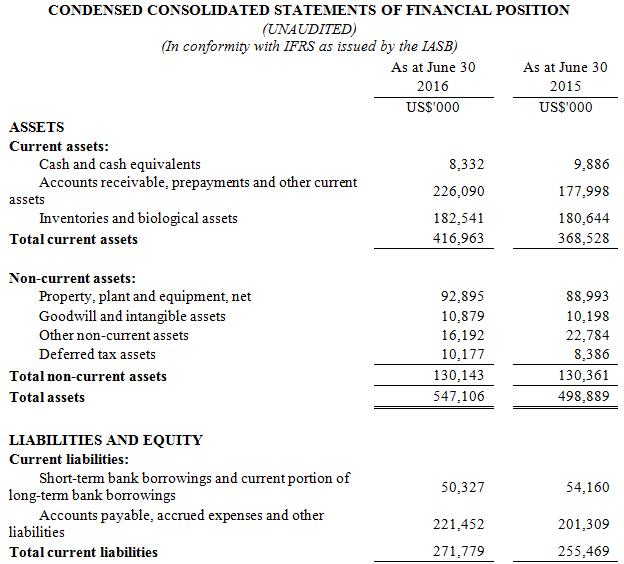

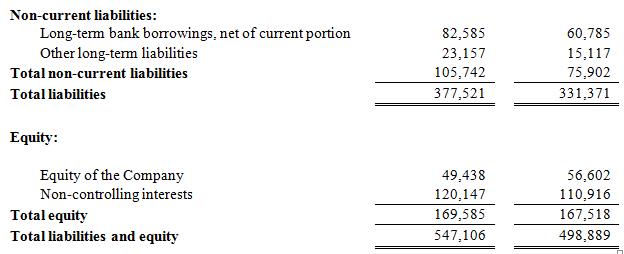

Note: All figures refer to fiscal year 2016 (i.e. twelve months ended June 30, 2016) unless otherwise noted. Comparisons of Consolidated Statements of Profit or Loss are to fiscal year 2015 (i.e. twelve months ended June 30, 2015). Comparisons of Consolidated Statements of Financial Position are to June 30, 2015 unless otherwise noted. All references to “PGW” refer to the company’s primary operating subsidiary, PGG Wrightson.

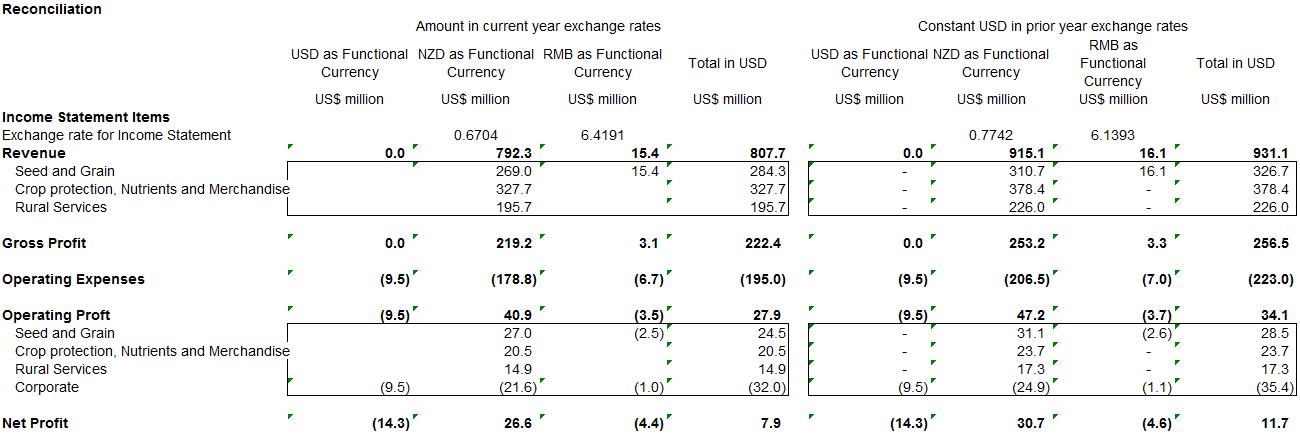

While the Company reports results in US Dollars, it transacts the majority of its business in New Zealand dollars. To assist in understanding the underlying economic trends of the business, the presentation below reports results both in USD in conformity with IFRS, and on a “constant currency” basis that removes the significant impact of volatility in the average USD/NZD foreign currency exchange rates during the reporting period. “Constant currency” analysis is a non-IFRS measure. Management utilizes local currency comparisons in evaluating the business, and believes this non-IFRS disclosure can aid readers in their analysis of the Company’s results.

The company estimates the constant currency growth rate by translating current period figures at the NZD/USD exchange rate used in reporting the prior period results. During the reporting period, the New Zealand dollar depreciated by 13% against the US dollar. Please see the reconciliation table included in this release for more detail.

Financial Highlights:

Revenue was $807.7 million, a decrease of 14.5%. Gross profit declined by 11.4% to $222.4 million, while gross profit margin increased to 27.5%, a 97 basis point expansion. Operating expenses were $195.0 million, a 7.1% decline. Operating profit declined 32.4% to $27.9 million, or 3.5% of revenue. Net profit was $7.9 million, down 46%. Net loss attributable to shareholders was ($8.0) million, or ($0.07) per share.

On a “constant currency” basis: revenue decreased 1%, and gross profit increased by 2%. Operating expenses increased 6%, and operating profit declined 17%. Net profit declined 20%.

Operating profit declined as an increase in Crop Protection and unchanged profit in Seeds and Grain were offset by a decline in Rural Services and higher corporate overhead, both at the PGW subsidiary and the corporate level.

The table below summarizes the impact of exchange rate changes on consolidated results.

|

|

FY2016 |

FY2015 |

Y/Y Change |

FY2016 Constant Currency |

Y/Y Change Constant Currency |

|

Revenue |

$807.7 |

$944.7 |

(15%) |

$931.1 |

(1%) |

|

Gross Profit |

$222.4 |

$250.9 |

(11%) |

$256.5 |

2% |

|

Gross Margin |

27.5% |

26.6% |

+97 bps |

27.5% |

+97 bps |

|

Operating Expenses |

$195.0 |

$209.9 |

(7%) |

$223.0 |

6% |

|

Operating Profit |

$27.9 |

$41.3 |

(32%) |

$34.1 |

(18%) |

|

Net Profit |

$7.9 |

$14.7 |

(46%) |

$11.7 |

(20%) |

|

Shareholders Net |

($8.0) |

($0.5) |

|

($6.8) |

|

Balance sheet changes during the period were mixed. Cash decreased by approximately $1.6 million to $8.3 million. Receivables and inventory were up $48.1 million, while debt increased $18.0 million and other liabilities increased $28.2 million.

On a “constant currency” basis, cash decreased by approximately $1.6 million. Sources of cash were an inventory decline of $4.7 million, a payables increase of $20.3 million, and a debt increase of $14.7 million. The major offsetting uses of cash were prepayments that increased $15.2 million and a payment to a related party for the funding of a pending transaction to purchase their equity interest in Agria Investments Asia, the vehicle through which the Company owns its stake in PGW.

Mr. Alan Lai, Agria's Executive Chairman, commented, “In light of poor trading conditions in the dairy sector and unfavorable foreign exchange impact, we are pleased with our better-than-expected fiscal year 2016 results. Notably, our performance strengthened throughout the second half of the fiscal year, despite challenging weather that impacted operations in South America. Our performance in fiscal year 2016 continued to demonstrate our ability to accomplish our near-term objective of building a solid foundation to drive profitable growth. We believe that we have the right team in place to continue to deliver growth in our principal businesses in New Zealand, as well as expand our capabilities within our other major markets of Australia, South America and China.”

Business Highlights:

Seed and Grain

Operating profit of $24.5 million was 41% of the group total before corporate overhead, and was down 15%. Revenue was $284.3 million, which constituted 34% of group revenue, and was down 12%. On a constant currency basis, revenue was up 1%, and operating profit was down 1%. Operating profit benefitted from a focus on driving product mix to higher margin proprietary seeds. Southern Hemisphere operating profit was up 9% (constant currency), offset by an operating loss in China Seeds. Results were strongest in Australia, with solid contributions from New Zealand domestic and export sales. Uruguay was weaker due to extensive flooding in April.

Crop Protection, Nutrients, and Merchandise

Operating profit of $20.5 million was 34% of the group total before corporate overhead, and was down 3%. Revenue was $327.7 million, which constituted 41% of group revenue, and was down 15%. On a constant currency basis, revenue was down 2%, and operating profit was 11% higher. The slightly lower revenue reflected cautious spending by New Zealand farmers, as they reacted to lower dairy prices. The operating profit increase was due to a mix shift to higher value products, and strength in beef and horticulture-related products.

Rural Services

Operating profit of $14.9 million was 25% of the group total before corporate overhead, and was down 25%. Revenue was $195.7 million, which constituted 25% of group revenue, and was down 17%. On a constant currency basis, revenue was down 4%, while operating profit was 13% lower. Livestock operating profit was down slightly as operating margin improvement offset lower revenue. Operating profit in the balance of rural services was down 29%, due to softness in the water business.

Constant Currency Reconciliation

While the Company reports results in US Dollars, it transacts the majority of its business in New Zealand dollars. In order to calculate the constant currency growth rate of various financial measures presented here, the company translated current period figures at the NZD/USD exchange rate used in reporting the prior period results. For the IFRS-compliant presentation, all current period figures were translated to USD at the rate of 0.6704 USD per NZD. Constant currency growth was calculated by translating current period figures at the rate of 0.7742 USD per NZD. The table below reconciles the IFRS-compliant results to the constant currency growth calculation.

About Agria Corporation

Agria (NYSE: GRO) is a global agricultural company with three principal business segments: Seed and Grain; Crop Protection, Nutrients and Merchandise; and Rural Services. The Seed and Grain segment is engaged in research and development, production and sale of a broad range of seed products and trading of seed and grain products globally. The Crop Protection, Nutrients and Merchandise segment operates an extensive chain of retail stores that supply farm input materials. The Rural Services segment provides livestock trading, wool trading, irrigation and pumping, real estate agency and other agriservices. For more information about Agria Corporation, please visit www.agriacorp.com.

Safe Harbor Statement:

This announcement contains forward-looking statements. These statements, including the management’s commentary, are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “confident” and similar statements. Agria may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission on Forms 20-F and 6-K, etc., in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about Agria’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Potential risks and uncertainties include, but are not limited to, those risks outlined in Agria’s filings with the U.S. Securities and Exchange Commission. All information provided in this press release is as of the date of this announcement unless otherwise stated and Agria does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

Contact:

The Blueshirt Group

Asia

Gary Dvorchak, CFA

Phone (China): +86 (138) 1079-1480

Email: gary@blueshirtgroup.com

United States

Ralph Fong

Phone: +1 (415) 489-2195

Email: ralph@blueshirtgroup.com

Statement Regarding Unaudited Financial Information

The unaudited financial information set forth above is subject to adjustments that may be identified when audit work is completed on our year-end financial statements, which could result in significant differences from this unaudited financial information.